Offers a range of account types and a user-friendly trading platform.

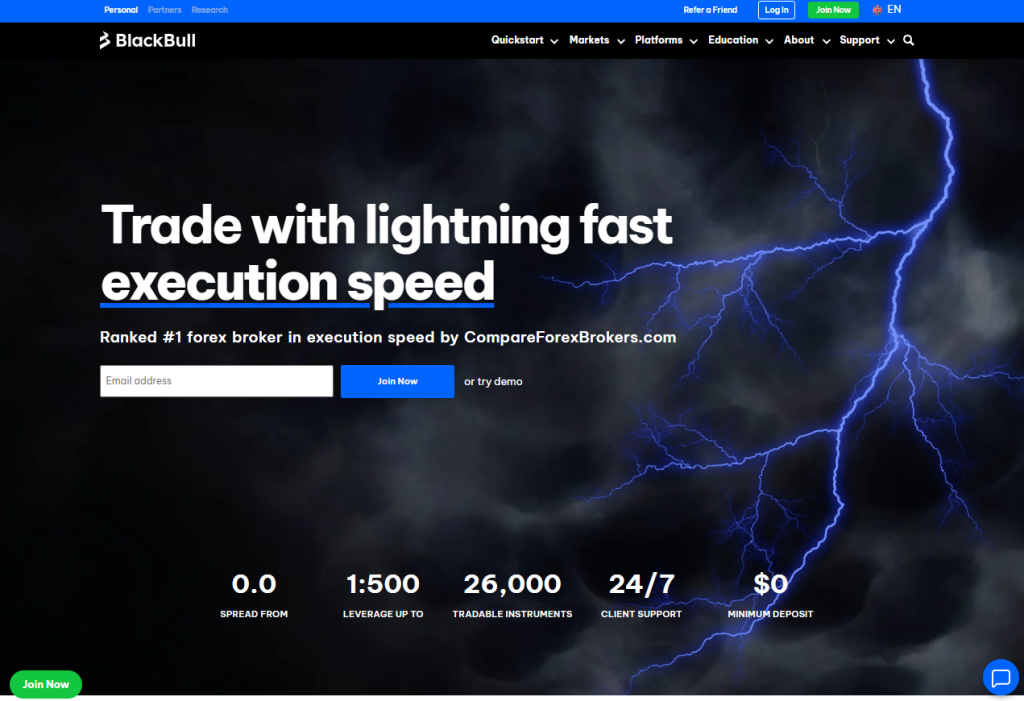

Black Bull Markets, established in 2014, is a forex and CFD broker overseen by the Financial Markets Authority (FMA) of New Zealand. This regulatory framework ensures a high standard of security and transparency for its clients. The broker caters to a global clientele, offering a diverse range of trading instruments, such as forex pairs, commodities, indices, and shares. In addition to this, Black Bull Markets provides access to multiple trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and ZuluTrade.For a comprehensive overview of Black Bull Markets, you can refer to our Black Bull Broker Review.

These platforms offer advanced charting tools, technical indicators, and automated trading capabilities, catering to both novice and experienced traders. Furthermore, the broker offers a variety of account types, each with its own set of features and benefits, allowing traders to choose the one that best suits their trading style and risk tolerance. Check below Black Bull Broker Review on the basis of pros & cons.

- Regulated Broker

- Diverse Trading Instruments

- Competitive Spreads

- Fast Execution Speeds

- Negative Balance Protection

- Limited Educational Resources

- Higher Minimum Deposit for Some Accounts/li>

- Mixed Reviews on Customer Support

In addition to competitive trading conditions, BlackBull Markets provides educational resources and customer support to assist traders at every stage of their journey. The broker’s commitment to client satisfaction and regulatory compliance has solidified its position as a reputable player in the forex industry.

BlackBull Markets offers a range of educational resources for traders of all levels. Their educational materials cover a wide range of topics, including forex basics, technical analysis, fundamental analysis, and risk management. While the quality of these resources is generally considered good, some users have noted that the depth and breadth of the educational content may not be as extensive as that offered by other brokers.

Is Blackbull Markets a Trustworthy Broker?

- Security: Segregated client funds, negative balance protection.

- Diverse Asset Classes: Offers a wide range of assets, including forex, commodities, indices, and shares.

- Competitive Spreads: Provides competitive spreads, especially on popular pairs.

- Multiple Trading Platforms: Supports popular platforms like MetaTrader 4 and 5.

- Educational Resources: Offers educational resources for traders of all levels.

- Mixed Reviews on Withdrawal Processing Times: Some users have reported delays in withdrawal processing.

- Not Available in All Regions: The broker may not be accessible to traders in certain regions.

QUICK VIEW

| Minimum Deposit | 200 $ – 2000$ |

| Leverage | 500 : 1 |

| Scalping | yes |

| Volume | 100 lots |

| Minimum Lot | 0.01 lot |

| Margin Call | 70% |

| Stop Out | 50% |

| Spread | floating |

| Execution | Market |

| Islamic Account | yes |

FEES

| Commission | 0 $/lot – 6 $/lot |

| Inactivity fee | None |

FUND MANAGERS & INVESTORS

| Social Trading | ZuluTrade, Myfxbook AutoTrade |

| Pamm Trading | Available |

INSTRUMENTS AVAILABLE FOR TRADE

CFDs, Commodities, Energies, Indices, Metals

OVERALL

Black Bull Markets is generally considered a reliable and trustworthy forex broker. Its regulation by the FMA, strong security measures, and diverse offerings make it a suitable choice for many traders. However, potential clients should be aware of potential delays in withdrawal processing and the limited availability of account types.

Before you proceed with opening an account or placing any order, please ensure that you have thoroughly read and understood all the legal documents provided by Blackbull Markets.

Disclaimer: Information Accuracy

We strive to provide accurate and up-to-date information. However, if you notice any discrepancies or errors in the content provided, please don’t hesitate to contact us at [email protected]. Your feedback is valuable in helping us maintain the quality of our information.