- Vast selection of 200+ crypto CFDs and robust crypto tools.

- Offers MetaTrader, TradingView, and MT5’s FlashTrader EA plug-in.

- AI-powered economic calendar adds a smart trading edge.

- Limited research content and sparse educational videos.

- Market range is narrow compared with top multi-asset brokers.

- No proprietary mobile app; relies on third-party platforms.

Australia-based broker Eightcap offers its trading services through MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView platforms. One of the standout features of Eightcap is the ability to open two trading accounts simultaneously, with access to 1,000+ trading instruments across multiple markets.

This detailed Eightcap Review covers key aspects such as trading costs, leverage options, mobile app performance, and the demo account experience.

What sets Eightcap apart is its competitive pricing, a diverse range of trading assets including forex, commodities, indices, and stocks, and exceptional customer support that efficiently handles client queries.

Whether you’re a seasoned trader or just starting your trading journey, Eightcap provides a flexible, user-friendly, and well-supported environment to help you make the most of the forex market.

Eightcap Broker Overview

Eightcap began its journey with a clear mission — to deliver top-tier trading services to aspiring and professional traders alike. This vision has remained at the heart of the company’s growth, helping it expand globally and earn a strong reputation in the trading industry. Today, Eightcap offers access to over 800 trading instruments, including forex pairs, stocks, commodities, and indices, reflecting its commitment to providing an exceptional trading experience.

Over the years, Eightcap has earned multiple prestigious awards, recognizing its excellence and innovation. Notable accolades include Best CFD Broker in Australia (2022), Most Innovative Affiliate Program, and Best Crypto Broker, along with honors for outstanding customer service and support. These achievements highlight the broker’s dedication to continuous improvement and client satisfaction.

Eightcap also ensures traders have access to industry-leading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView, reinforcing its focus on innovation and usability.

- Vast selection of 200+ crypto CFDs and robust crypto tools.

- Offers MetaTrader, TradingView, and MT5’s FlashTrader EA plug-in.

- AI-powered economic calendar adds a smart trading edge.

- Limited research content and sparse educational videos.

- Market range is narrow compared with top multi-asset brokers.

- No proprietary mobile app; relies on third-party platforms.

Eightcap Summary

| 🏢 Headquarters | Melbourne, Australia |

| 📆 Established | 2019 |

| 🗺️ Regulation | ASIC |

| 🖥 Platforms | MetaTrader 5 and cTrader |

| 📉 Instruments | Forex, Commodities, Indices, Shares and Cryptos |

| 💳 Minimum Deposit | $100 |

| 💰 Deposit Methods | Credit/debit card, Cryptocurrencies, PayRetailers, Bank Wire, Worldpay, Fasapay, Neteller, PayPal, BPAY, Skrill ( *This depends on the country of residence of the client. ) |

| 📱 Mobile Trading | Yes |

| 🌍 Web Trading | Yes |

| 💵Minimum Trade Size | 0.01 Lots |

| 🎢 Maximum Leverage | Up to 1:500 ( *This depends on the country of residence of the client. ) |

| 🌍 ECN | Yes |

| 🤖 Robots | Yes |

| 🎯 Scalping | Yes |

| ☎ Customer Support | 24/5 |

Eightcap Review Regulations

Having established a strong presence across multiple jurisdictions, Eightcap demonstrates a clear commitment to high standards of transparency, security, and regulatory accountability. The broker is regulated in four major jurisdictions by leading financial authorities: Australian Securities and Investments Commission (ASIC), Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and Securities Commission of The Bahamas (SCB).

In Australia, the broker operates as Eightcap Pty Ltd under ABN 73 139 495 944. It is authorised and supervised by ASIC and holds an Australian Financial Services Licence (AFSL) 391441, confirming its compliance with Australia’s strict financial regulations. The company’s registered office is located at The Rialto, South Tower, Level 35, 525 Collins Street, Melbourne VIC 3000, Australia.

Within the United Kingdom, Eightcap operates through Eightcap Group Ltd, which is fully regulated by the FCA. The firm is registered under FRN 921296, reflecting adherence to the UK’s robust regulatory framework for financial services. Its UK head office is situated at 40 Gracechurch Street, London, EC3V 0BT.

For European clients, Eightcap provides services through Eightcap EU Ltd, its Cyprus-based entity. This branch is authorised and regulated by CySEC under licence number 246/14, ensuring compliance with European financial regulations and investor protection standards. The company’s registered address in Cyprus is Anexartisias 187, 1st Floor, 3040 Limassol, Cyprus.

Overall, Eightcap’s multi-regulatory structure across respected global authorities reinforces its credibility and positions the broker as a secure and trustworthy choice for traders worldwide.

Eightcap : Account Types

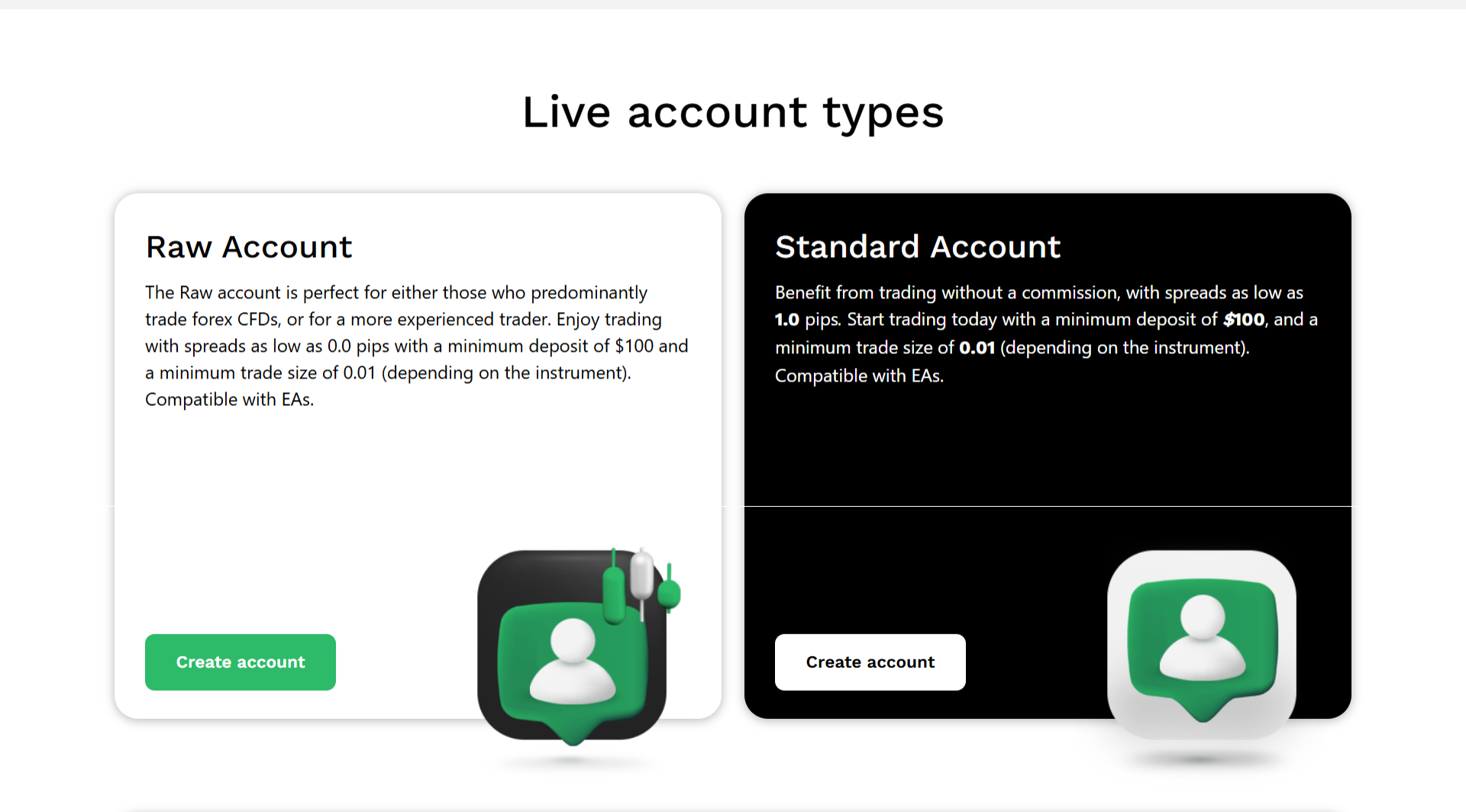

Eightcap mainly offers two types of accounts, Raw and Standard accounts. Additionally, they also offer TradingView account. However, all these accounts have different features. These also feature Islamic account. Let’s get to know each account type.

Benefits of TradingView with Eightcap

Trading with Eightcap becomes even more powerful through its seamless integration with TradingView, a leading charting solution known for its advanced tools and trader-focused features. This integration allows traders to analyze, plan, and execute trades with greater clarity and confidence.

With TradingView, you can chart your trades using 15+ chart types, including Kagi, Renko, and Point & Figure, among others. Traders can view up to eight charts per tab, sync symbols and timeframes, and use 90+ intelligent drawing tools to enhance technical analysis. The platform’s flexibility ensures a smooth trading experience whether you’re at home or on the move. The TradingView mobile app for iOS and Android connects directly to your Eightcap account, making it easy to manage trades from anywhere.

Traders can further sharpen their strategies by accessing a vast library of premium technical indicators and industry-standard measurement tools. With over 100,000 community-built indicators, there’s no shortage of options to customize and refine your approach. For advanced users, TradingView also supports the creation of custom indicators using Pine Script, its proprietary programming language.

TradingView’s social and alert features add another layer of value. You can exchange ideas with fellow CFD traders, discover fresh trade setups through community discussions, and stay ahead of market moves with customizable alerts. Alerts can be set for price levels, built-in indicators, or even custom indicators, with the ability to create multiple alert configurations to track potential opportunities in real time.

Getting started with trading Eightcap directly on TradingView is simple:

-

Create an Eightcap account and select TradingView as your preferred platform.

-

Open a chart on TradingView and navigate to the Trading Panel.

-

Choose Eightcap from the broker list and follow the prompts to connect your account.

Once connected, you can trade directly from TradingView with ease.

To further enhance the experience, Eightcap complements this integration with comprehensive educational resources. Through Eightcap Labs, traders can bridge the gap between theory and real-market application. The Trade Zone offers expert insights, weekly trade ideas, market forecasts, and mid-week commentary webinars—helping traders stay informed and prepared.

With low spreads and access to 800+ financial instruments, trading with Eightcap via TradingView delivers a dynamic, flexible, and education-rich trading environment—designed to help traders perform at their best.

Eightcap: Assets & Markets

Our evaluation shows that Eightcap offers an impressive and well-diversified range of tradable instruments. The broker particularly stands out in share CFDs, giving traders access to leading and widely recognised companies across major global markets, including the US, UK, Australia, and Europe. In addition, Eightcap provides broader cryptocurrency trading opportunities than many competing brokers.

Traders can access 40 major, minor, and exotic forex pairs, allowing exposure to both mainstream and niche currency markets. The broker also offers share CFDs on more than 500 companies, listed on major exchanges such as the NASDAQ and NYSE (US), LSE (UK), XETRA (Germany), and Australian exchanges.

Crypto-focused traders benefit from a wide selection of 250+ cryptocurrency pairs, including cross pairs and crypto indices. Alongside this, Eightcap provides access to 10 major index CFDs, including popular instruments like US30, UK100, and SPX500. To further diversify trading strategies, traders can also speculate on commodity CFDs such as gold, silver, and oil.

Overall, Eightcap’s extensive instrument offering makes it a strong choice for traders seeking variety across forex, shares, cryptocurrencies, indices, and commodities.

Eightcap : Spreads & Commissions

Our analysis of Eightcap shows that the broker offers tight and competitive spreads, which can vary depending on market conditions and liquidity.

For major forex pairs on the Raw Account, spreads can start from 0.0 pips. On popular indices such as SPX500, spreads may begin from around 0.4 points. Commodity traders can also benefit from low pricing, with gold spreads starting near 0.12 USD and oil from approximately 0.03 USD.

Cryptocurrency trading costs vary by asset. For example, the spread on Bitcoin Cash can be as low as 0 USD, while Bitcoin spreads may reach up to 31.2 USD, depending on market volatility. When trading shares, the spread is typically around 0.02 USD per share, resulting in roughly 4 USD per share for a complete round-trip trade (buy and sell).

It’s important to note that spreads can widen during periods of high volatility, low liquidity, or major market events, which is common across all brokers.

On the Raw Account, Eightcap charges a commission of 3.50 USD per lot per side, making it a cost-effective option for active traders and scalpers.

Additionally, traders who hold forex positions overnight may incur swap (overnight) fees, depending on the instrument traded and prevailing interest rate differentials.

Overall, Eightcap’s transparent pricing structure and competitive spreads make it well-suited for traders seeking low trading costs across multiple asset classes.

Deposits and Withdrawals at Eightcap

Eightcap offers multiple convenient ways to fund your trading account. Simply choose your preferred payment method, enter the amount you wish to deposit, and wait for confirmation. Available options may include credit or debit cards, UnionPay, cryptocurrencies, and other local methods, depending on your country of residence.

Eightcap does not charge any fees for deposits or withdrawals. However, it’s important to note that your bank, card provider, or payment processor may apply transaction, international transfer, or currency conversion fees—and these costs are borne by the client.

When you request a withdrawal, Eightcap’s Finance team reviews it first, which typically takes 1–2 business days. After approval, the funds are processed according to the standard timeframes of the chosen payment method.

If a payment method is described as “instant,” it means the transaction is processed automatically within seconds, without manual intervention from the finance department. Eightcap does not apply hidden charges at any stage, but international transfers—especially from non-Australian banks or cards—may incur third-party fees.

For security and compliance reasons, the name on your bank account or card must match the name on your Eightcap trading account. Joint accounts are accepted as long as one of the account holders matches Eightcap’s records. Third-party payments and cash deposits are not permitted.

You can fund your trading account at any time. If a deposit is not credited instantly, Eightcap aims to complete it within one business day during operating hours. Delays caused by external payment providers or system issues are outside the broker’s control. Internal transfers between accounts under the same name are processed instantly. In certain regions, local regulations may apply to specific payment methods.

For cryptocurrency withdrawals, you must use the same wallet address that was used for the deposit. If a new wallet address is requested, additional verification may be required, such as a recent photo ID or passport, the new wallet address, and a short facial verification video to confirm account ownership.

Overall, Eightcap’s deposit and withdrawal process is transparent, flexible, and designed to prioritize both convenience and security for traders worldwide.

Trading Platform

Our hands-on testing of Eightcap’s trading platforms shows that they are reliable, flexible, and built to a high standard. Traders can choose from industry-leading platforms like MetaTrader 4 and MetaTrader 5, both widely trusted for their stability and advanced trading tools.

In addition, Eightcap integrates Capitalise.ai, which allows traders to automate strategies without manual coding—an attractive feature for those looking to streamline their trading process.

The ability to select a platform that matches your specific trading style and objectives, including strategies such as scalping or automation, is a major advantage and makes Eightcap appealing to a broad range of traders.

MetaTarder 4

If you want to trade online, you should use the Eightcap MT4 platform. Commodities (such as oil or gold) and indices (forex) are among the investment options. It allows you to make trades automatically and is straightforward to use. You won’t believe how useful the charts are. Everyone, but especially newcomers, should check out this platform. It has some awesome features:

MetaTrader 5

MT5 is great if you want to do even more with your trading. It covers more types of assets and gives you more tools to use. After upgrading from MT4, you’ll have even more options with the new MetaTrader 5 (MT5) Eightcap platform. You have the option to trade cryptocurrencies, indices, stocks, commodities, and currency. It’s somewhat similar to MT4, but with more power. Some of the awesome features it offers are:

Eightcap WebTrader

Eightcap also provides a WebTrader version of MT5, subject to your country of residence. This platform can be accessed directly through the broker’s website, so there’s no need to download or install any software.

The MT5 WebTrader includes the same core features and functionality as the desktop version, allowing traders to analyze markets, place trades, and manage positions seamlessly. It’s a fast and convenient way to start trading and stay connected to global financial markets from anywhere.

| Capitalise.ai | FlashTrader | Crypto Crusher |

| At Eightcap, there’s a really cool tool for trading automatically, named Capatilise.ai. It lets you tell the system what to do using normal words, like “buy $1,000 GBP/USD on Tuesday at 15:30 EST.” The dashboard looks great, and it helps you make automated trading plans even if you’re just starting out. With this tool you can generate your very own trading plans, but you don’t need to pay any money. We also really liked that Capitalise.ai has a bunch of ready-made strategies. You can test these without any risk, or you can adjust them to fit what you want before you start using them for real. | Eightcap offers FlashTrader, that makes trading easier. It adds stop-loss and profit-target levels automatically to every trade you make. . Instead of cutting your profits short, FlashTrader can help you take profit on half of your trade, move the stop-loss to where you started, and aim for a bigger second profit level. This tool also helps you manage your risk, make your trade sizes equal, and go for multiple profit levels. And the best part is, you can do all this with just one click using FlashTrader. FlashTrader: Eightcap offers FlashTrader, that makes trading easier. It adds stop-loss and profit-target levels automatically to every trade you make. Instead of cutting your profits short, FlashTrader can help you take profit on half of your trade, move the stop-loss to where you started, and aim for a bigger second profit level. This tool also helps you manage your risk, make your trade sizes equal, and go for multiple profit levels. And the best part is, you can do all this with just one click using FlashTrader. | You can receive trade ideas every day in real-time using special tools that only this company has. This tool will surely help you to learn more about the markets. You can use them to figure out how risky the market is and see how other people feel about it. You can also see how the market is moving and when it might change. If you’re interested in cryptocurrencies, you can keep an eye on their prices and trends with lots of special indicators made just for them. It’s like having a helpful guide to make better trading decisions. |

Eightcap : Customer Support

Our research and hands-on experience with Eightcap show that the broker delivers highly responsive and reliable customer support. During our live chat test, we were connected with a support agent in under a minute—significantly quicker than what most forex and CFD brokers typically offer.

Eightcap provides 24/5 customer support through multiple channels, including phone, email, and live chat, ensuring traders can get timely assistance whenever the markets are open.