Our research on FP Markets Review revealed that First Prudential Markets (FP Markets) is a leading CFD and retail forex broker headquartered in Sydney, Australia — right next to the Australian Securities Exchange. Founded in 2005 by Matthew Murphie, the company has built a solid reputation backed by strong regulatory oversight and industry recognition.

FP Markets began operations after obtaining an Australian Financial Services License from ASIC (Australian Securities and Investments Commission). Over the years, the broker has earned high praise from both industry experts and clients for its transparency, reliability, and quality of service.

In 2019, the Investments Trend Australia Leverage Trading Report recognized FP Markets as the Forex and CFDs provider with the “Best Quality of Trade Execution.” A year earlier, in 2018, FP Markets received a license from the Cyprus Securities and Exchange Commission (CYSEC) and partnered with ASM Golf Academy in South Africa.

The broker’s award-winning journey continued when it was named the “Best Global Forex Value Broker” at the Global Forex Awards 2019 in Limassol, Cyprus. More recently, FP Markets was honored with “Best Trade Execution” and “Most Transparent Broker” at the Ultimate Fintech Awards APAC 2023. The same year, it achieved a second consecutive Hat-Trick at the Global Forex Awards 2023, winning “Best Value Broker – Global,” “Best Broker – Europe,” and “Best Partners Programme – Asia.”

FP Markets has also been recognized for its innovation, launching a redesigned Client Portal that offers enhanced functionality, a modern interface, and new tools to help traders manage their portfolios more efficiently. The broker has expanded its commodity CFDs range, further enabling diversification opportunities for clients.

In 2023, FP Markets received the Best Forex Trading Tools award, reinforcing its status as one of the most trusted brokers in the global trading industry.

Further strengthening its international presence, FP Markets’ Kenyan subsidiary was granted a non-dealing Foreign Exchange Broker License by the Capital Markets Authority (CMA). This follows its 2022 authorization from the Financial Sector Conduct Authority (FSCA) of South Africa, demonstrating its growing regulatory footprint across multiple continents.

- Ultra-competitive spreads on Raw ECN account via MetaTrader and cTrader.

- Supports MetaTrader, cTrader, TradingView, and Autochartist tools.

- Access to 10,000+ tradeable symbols via the Iress platform.

- Mobile app lacks tools and charting found on the best mobile trading apps.

- Research and education content trails leading brokers like IG.

- Iress platform fees add up unless you’re an active or high-balance trader.

FP Markets Summary

| 🏢 Headquarters | Australia |

| 📆 Established | 2005 |

| 🗺️ Regulation | ASIC, CySEC, St. Vincent & Grenadines (non-European Countries), FSP, South Africa (FSCA) and Kenya (CMA) |

| 🖥 Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, Iress and cTrader, TradingView. |

| 📉 Instruments | 13,000+ Products Forex, Indices, Commodities, Metals, Cryptocurrencies, Bonds, ETFs |

| 💳 Minimum Deposit | $100 |

| 💰 Deposit Methods | Visa, MasterCard, PayPal, Bank/Wire Transfer, Neteller, Skrill |

| 💰 Withdraw Methods | CZK, PLN, AED on Visa/Mastercard – International Bank Wire – No fees, INR, BRL on Neteller, DragonPay, SticPay, PayTrust88, PerfectMoney, VirtualPay, Rupee, Xpay, LuqaPay, Rapid, Pagsmile, LetKnowPay, Finrax, Pay Retailers |

| 📱 Mobile Trading | Available |

| 🌍 Web Trading | Available |

| 💵Minimum Trade Size | 0.01 |

| 🎢 Maximum Leverage | 1: 500 |

| 🌍 ECN | Available |

| 🤖 Robots | Available |

| 🎯 Scalping | Allowed |

| ☎ Customer Support | 24/7 |

FP Markets Regulation

To protect traders’ interests and uphold client rights, FP Markets operates under the supervision of top-tier regulatory authorities. In Australia, the broker is regulated by the Australian Securities and Investments Commission (ASIC), while its European operations are overseen by the Cyprus Securities and Exchange Commission (CySEC).

FP Markets is also registered in South Africa as a Financial Services Provider (FSP) and is authorised and regulated by the Financial Sector Conduct Authority (FSCA). This multi-jurisdictional regulation framework is designed to ensure fair treatment of traders and full compliance with legal and operational standards.

The broker adheres to strict capital adequacy requirements, ensuring it can meet client withdrawal obligations at all times. FP Markets maintains robust risk management systems, transparent financial reporting, qualified personnel, and regular external audits. Importantly, client funds are held in segregated accounts, meaning trader money is kept separate from company operating funds and is never used for business expenses.

To further strengthen its trading environment, FP Markets partners with leading global liquidity providers, including HSBC, Goldman Sachs, JPMorgan Chase, and Barclays, among others. These partnerships provide access to deep, multi-asset and interbank liquidity, enabling FP Markets to offer ECN pricing and Direct Market Access (DMA).

Overall, FP Markets’ strong regulatory standing, institutional liquidity partnerships, and commitment to fund security reinforce its position as a transparent, secure, and professionally managed broker.

Bonus for Deposits & Promotions

During our FP Markets review, we closely examined the broker’s bonus terms and promotional conditions. There are several important points traders should understand about the welcome bonus, which is typically announced through online advertisements, email campaigns, or direct phone communication.

FP Markets offers a welcome bonus for new MT4 clients. According to the eligibility criteria, newly registered traders who successfully complete the account opening and compliance verification process may qualify for this promotion. The bonus amount is usually fixed at USD 30, or the equivalent value in the trader’s base currency.

In addition to the welcome bonus, our research also confirms that FP Markets provides a free VPS (Virtual Private Server) as a promotional benefit. To qualify for the VPS, traders must either deposit a minimum of USD 500 or meet specific trading volume requirements—at least 10 lots on a Standard account or 20 lots on a Raw account. The VPS is connected to the broker’s dedicated trading servers, making it particularly useful for traders who rely on automated strategies, EAs, or low-latency execution.

Overall, these promotions add extra value for traders, especially those looking to test the platform or enhance their trading performance with professional-grade tools.

Trading Fees

There isn’t a single, universal formula that can clearly rank high or low trading fees at FP Markets. However, reviewing practical trading scenarios helps provide a realistic view of the broker’s overall cost structure—especially across CFDs and 70+ forex pairs.

To assess whether FP Markets’ fees are competitive, we can examine common trading situations involving index CFDs, stock CFDs, and forex pairs.

In this scenario, a trader opens a leveraged position, holds it for one week, and then closes the trade. For index and stock CFDs, we assume a $2,000 position on instruments such as SPX or EUSTX50, while for forex trading, we consider a $20,000 position.

The leverage used in this example is 1:20 for stock index CFDs, 1:5 for stock CFDs, and 1:30 for forex trades, in line with European regulatory limits. Traders based in South Africa, however, can access leverage up to 1:500 on more than 70 forex pairs, with spreads starting from 0 pips.

This approach allows us to factor in spreads, commissions, and overnight financing (swap) costs, all of which play a crucial role in determining the true cost of trading. Evaluating fees in this way provides prospective traders with a clearer and more practical understanding of whether FP Markets’ pricing structure aligns with their trading needs and strategies.

Withdrawal Options

We went straight to the source for our FP Markets review and checked out the available withdrawal options provided by the broker. On average, the withdrawal time for FP Markets is one business day. In bank transfers, it is the same time frame, after accurate documents are received.

You can withdraw using:

FP Markets Deposit Options

The deposit options are almost the same as the withdrawal options you get. The channels are the same, and the base currencies do not change much. You can make your FP Markets deposit using:

With all the available methods, you can use the one that works best for you. FP Markets’ commitment to convenience clearly shows. For South African traders you can also deposit through Virtual Pay (African Payment Method) with the following currencies supported: KES, UGX, TSH.

FP Markets Account Opening

The account opening process at FP Markets is simple, fast, and entirely digital. Traders also have the option to open an FP Markets demo account, which the broker strongly recommends—especially for beginners who want to practice trading and identify areas for improvement in a risk-free environment.

To get started, you’ll need to submit your personal details along with information about your trading experience. Next, you configure your trading account, review the terms, and complete the required declarations.

The full application typically takes less than five minutes to complete. Once submitted, the final step is to wait for account approval.

As part of the verification process, FP Markets requires proof of identity and address. For identity verification, a passport, government-issued ID, or state-issued ID is sufficient. To confirm your address, you’ll need to upload a recent utility bill, bank statement, or another official document showing your residential address.

Overall, FP Markets offers a smooth and beginner-friendly onboarding experience, making it quick to move from registration to live trading.

FP Markets Account Types

There are two major FP Markets account types you can choose from when using MetaTrader. They are Standard and Raw. On the Iress platform, you can have Standard, Platinum, and Premier. There is further categorization when you consider ownership. FP Markets account types can be:

- Individual

- Joint

- Corporate

- Trust

To understand them fully, we will look at the relevant details you need to know before you choose one of them.

METATRADER ACCOUNTS:

| Standard (For MT4 and MT5) | Raw Account (for MT4 and MT5) |

| Spreads start from 1.0 pips. | Spreads start from 0.0 pips. |

| The commission (ASX) is 0 (Zero) | The commission is $3.5 (USD) |

| The minimum deposit is 100 Australian Dollars or an equivalent in your preferred base currency. | The minimum deposit is 100 Australian Dollars or an equivalent in your preferred base currency. |

| The maximum leverage is 1:500 | The maximum leverage is 1:500 |

FP MARKETS IRESS ACCOUNTS:

| Standard Account (FP Markets Iress) | Platinum Account (FP Markets Iress) | Premier Account (FP Markets Iress) |

| AUD 10 min, then 0.1% commission per lot | AUD 9 min, then 0.09% Commission per lot | No min, then 0.08% commission per lot |

| Minimum deposit of AUD 1000 | Minimum deposit of AUD 25,000 | Minimum deposit of $50,000 |

| Equity CFD margin rates start from 3% | Equity CFD margin rates start from 3% | Equity CFD margin rates start from 3% |

| Base rate is +4.0% | Base rate is +3.5% | Base rate is +3.0% |

With these basic details, you will know which one of these account types provided, is most suited to you. The best thing to consider is the style of trading, strategy, amount of money you are willing to risk, and your level of expertise.

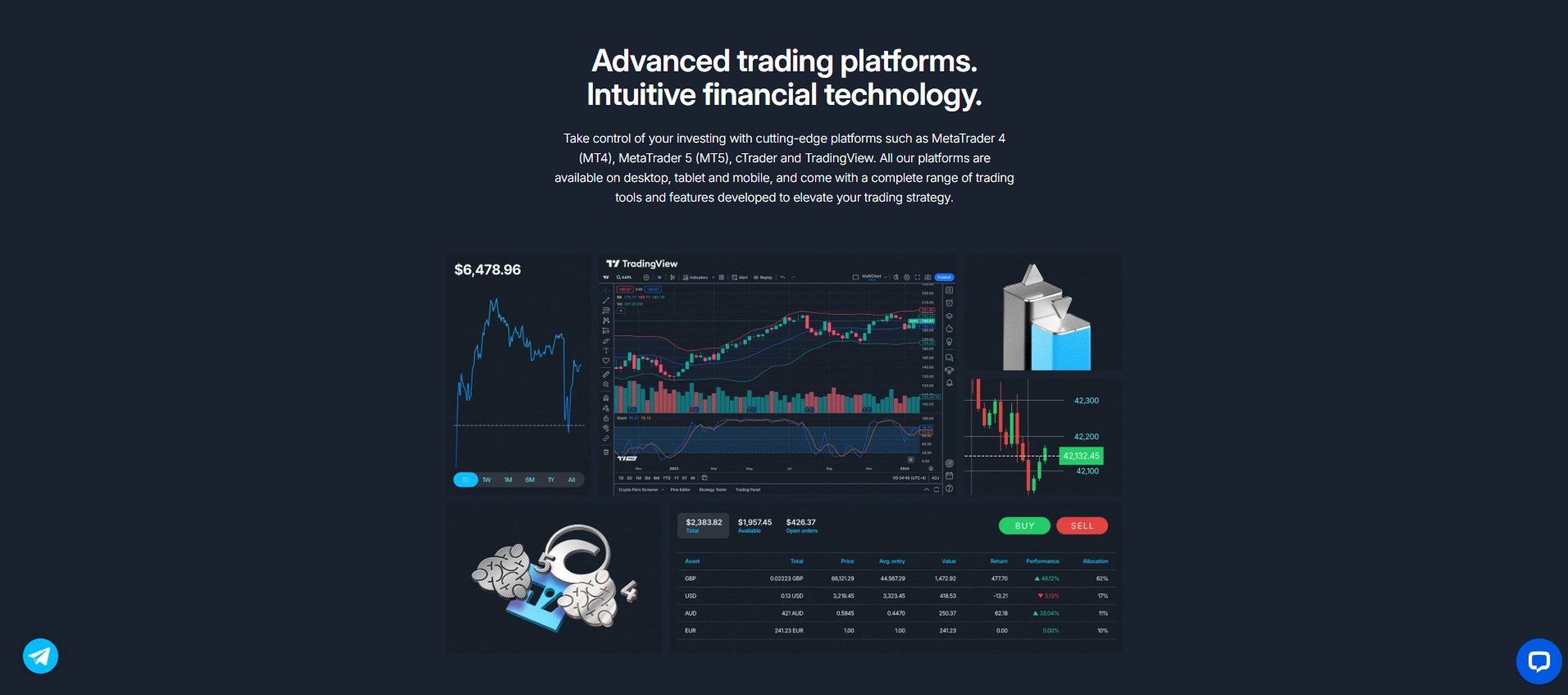

FP Markets Platforms

FP Markets has all the latest technology in trading software. As a trader, you want to have diversity so you can deploy your strategies properly. From the popular MetaTrader to the lesser-known but equally incredible Iress platform has it all.

You can choose from the following options:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- WebTrader

- Iress

- cTrader

- TradingView

You can enjoy access to Traders Edge Tools, the Affiliate Portal, the IB Portal, the Advanced Client portal, and MAM/PAMM accounts. All of these are here so you can choose the one that is most suited for you. If you prefer to trade by yourself, there are provisions for that.

If you would like to invest your money with expert traders, FP Markets ensures that you can. Let’s look at some of the details regarding these platforms and what they offer you.

MetaTrader 4

The MetaTrader 4 platform gives users an interface that they can customize to fit their style. In addition to that, it has one-click trading, prices are streamed live, you can access the FP Markets demo account if you want to, and MarketWatch is available.

The accounts have 128-bit encryption to ensure security for traders. There are many chart types one can use for each style of analysis.

The platform is available for use across all devices. Mobile device users can get FP Markets download options for iOS or Android, those who trade on the go can access it from their browsers as WebTrader, and if you prefer to be at a terminal, you can download it and install it into your PC.

MT4 and MT5 are essentially the same, with key differences in features. The MT5 version of MetaTrader features new functions that you will not find on MT4.

For example, on MT5, you will be given a stunning 61 pending order types, market depth, automated trading using Expert Advisors, and tools from the MQL5 community. These are all things you will not be able to get when using MT4.

Whichever version you choose, you are provided with a complete suite of trading tools, one-click trading, several order types, varying execution modes, price quotes in real-time, synchronization of data, and online multilingual support (available 24 hours a day, five days a week.)

The key goal here is to pick a version you are comfortable with and completely familiar with. If you are using something that confuses you, it could affect how you trade and profitability.

MetaTrader WebTrader

As mentioned earlier in this FP Markets review, the browser version has the same features you get when using the desktop versions. You will have access to ECN pricing and all the tools without going through installing the software on your device.

IRESS

Iress ViewPoint is the highlight of this platform. The complete Iress suite contains Iress ViewPoint, Iress Trader, and Iress Investor (for when you want to do some Direct Market access trading). With this platform, you will get many of the same features that MetaTrader has.

For instance, you can trade straight from your browser without installing or download the software and install it into your device.

The prices offered on the exchanges are genuine, while providing you with access to market depth. There are 59 technical trading indicators to aid in analysis, with over 50 tools just for drawing to enhance the analysis further.

The biggest selling point of Iress is that it gives you quotes in real-time for over 10,000 tradable financial instruments. That is a number much higher than any of the brokers in the market can provide.

cTrader

FP Markets is now offering cTrader, a leading multi-asset Forex and CFD trading platform, boasting advanced charting, advanced order types, level II pricing, powerful trading tools and superior execution.

FP Markets Trading Platforms on Mobile

Traders can enjoy full mobile trading flexibility by using MT4 and MT5 on both iOS and Android devices. The apps are easily accessible from the broker’s website, where users can download them directly to their smartphones or tablets.

These mobile platforms deliver the same core experience as the desktop and WebTrader versions, allowing traders to place manual trades, apply technical analysis tools, monitor charts, and manage positions seamlessly while on the move.

In addition, Iress also offers a dedicated mobile trading app for iOS and Android users. The mobile version mirrors the functionality of its desktop and browser-based platforms, providing access to dynamic pricing, real-time market news, order management, and advanced trading features.

Overall, the mobile trading options ensure that traders can stay connected to the markets anytime, anywhere—without compromising on tools, performance, or functionality.

FP Markets Commissions and Spreads

Cost is always a big issue when choosing a broker. Most of the things we consider do not matter unless you can afford to trade with a broker and stay profitable. Spending too much on trading costs can pull you back. However, FP Markets spreads, and commissions are not unreasonable or higher than normal. To get the full details, read their commissions, and spread information.

But before you do that, let’s look at some of the basic charges you can expect when trading with this broker.

- On the Standard MT4 and MT5 accounts, you will engage in trading without commission.

- In the Raw MT4 and MT5 accounts, you will engage in commission-based trading. The total round turn charge is 7 Australian Dollars.

Both of these accounts offer FP Markets ECN pricing execution, to ensure that you always get the best prices. In addition to that, they both offer different spreads and swap rates (where applicable), can be found on the FP Markets website.

Depending on the account you open, the fees can be different. On the Iress platform, you may have to pay a monthly trading charge. However, this charge is waived if your trading activities generate more than $150 in commissions each month for FP Markets.

There is an ASX live data feed charge that is waived, too, based on how much you trade in a month. The Standard Iress account charges a brokerage rate of $10 at the minimum and 0.1% after that.

FP Markets Education and Research

After spending more than ten years on the forex market scene and gaining a solid reputation, they have grown into a complete broker with provisions for anything you may need. In education, there is a variety of ways to learn.

FP Markets education comes in the form of:

- Articles

- EBooks

- Video tutorials

Most of the material can be found on the Traders Hub Blog, run by FP Markets. As a trader, you can access the videos, courses, and topics to get the most out of complete knowledge.

It doesn’t stop there because they have a YouTube channel full of tutorials that show you how to navigate the platforms provided.

It’s great to have education tools. However, they are not enough if you do not have research tools to ensure that trading goes as smoothly as possible. From the Traders Hub page, you can read the technical analysis and fundamental analysis given by experts.

Most of the analysis covers all asset classes, to ensure that whatever you’re trading, you are not left out.

There is video analysis, just like with their education, if you understand visual presentation better than words on a page. Compared to the other brokers on the market, this level of analysis is nothing short of impressive.

Both beginners and advanced traders will find the information easy-to-grasp and very useful in making trading decisions.

FP Markets Customer Service Experience

FP Markets provides 24/7 customer support, ensuring traders can get assistance at any time. Support is available through telephone, email, and Live Chat, with Live Chat being the fastest way to receive a response.

The broker offers multilingual support, including English, Chinese, Thai, German, Portuguese, Italian, French, and several other languages, making it accessible to traders worldwide.

FP Markets also maintains a detailed FAQ section, where many common questions are answered quickly and clearly. During our testing, Live Chat connected us to a support agent in under five seconds, and responses were prompt and helpful.

In addition, traders can stay connected with FP Markets through its official social media channels, including Facebook, Twitter (X), LinkedIn, and YouTube, providing updates, insights, and educational content.

The General Experience

With FP Markets, traders benefit from a well-rounded trading environment that includes ECN/STP market access, MAM/PAMM account solutions, powerful trading platforms, a responsive support team, and a range of distinctive features paired with flexible account types. All of this clearly highlights why FP Markets is regarded as one of the leading brokers in the industry.

The broker delivers all the core essentials a trader expects—competitive pricing, reliable execution, professional tools, and strong client support—allowing you to trade with confidence without feeling that anything important is missing.