Learning forex trading online can be an exciting and rewarding experience, and choosing the right broker is a key part of that journey. In this review, we take a closer look at a well-known global broker founded in 2011—formerly called OctaFX and now operating as Octa.

The broker has earned the trust of traders worldwide, with more than 42 million registered trading accounts spread across 180 countries. As discussed in this Octa review, the platform is widely recognised for its commission-free trading model and its strong focus on social responsibility, supporting humanitarian and educational initiatives within local communities.

Over the years, Octa has received 70+ international awards, including titles such as “Most Reliable Broker Asia 2023” and “Best Forex Broker 2026.” Let’s explore what sets Octa apart and why millions of traders continue to choose this broker globally.

- OctaTrader now includes AI-powered performance analytics.

- Copy trading and proprietary platforms available.

- Research includes forecasts, trading ideas, and third-party content.

- Offers swap-free and Sharia-compliant trading accounts.

- MT5 has 230+ symbols; only 80 on OctaTrader.

- No dates listed with spreads makes pricing unclear.

- The cTrader platform was recently discontinued.

Octafx Summary

| 🏢 Headquarter | Saint Lucia |

| 📆 Established | 2011 |

| 🗺️ Regulation | CyseC, FSCA ,MISA and FSCM |

| 🖥 Platforms | MetaTrader 4 and MetaTrader 5 and OctaTrader |

| 📉 Instruments | Currency Pairs, Stock, Indices, Commodities, Crypto, Shares |

| 💳 Minimum Deposit | $25 |

| 💰 Deposit Methods | Neteller, Skrill, Litecoin, Dogecoin, Tether ERC-20, Ethereum, bitcoin, Mastercard and Bank Transfer |

| 📱 Mobile Trading | Yes |

| 🌍 Web Trading | Yes |

| 💵 Octa Minimum Trade Size | 0.01 Lots |

| 🎢 Octa Maximum Leverage | Up to 1:1000 |

| 🌍 ECN | No |

| 🤖 Robots | Yes |

| 🎯 Scalping | Allowed |

| ☎ Customer Support | 24/7 |

Octa Regulations

Operating under several licenses in particular financial markets, Octa is able to offer services in numerous EU nations, South Asia, the Asia Pacific area, and some Middle Eastern countries. Octa is not authorized to provide services in some key areas, like the UK and the US, thus keep in mind as well.

Officially registered with registration number HE359992, Octa European branch, Octa Markets Cyprus, has a valid license from the Cyprus Securities and Exchange Commission (CySEC) under license number 372/18. CySEC rules cover European clients.

Mauritius licence: Uni Fin Invest, company registration number: C186509, Investment Dealer Licence no. GB21027161 from the Financial Services Commission, Mauritius.

Octa is present in Santa Lucia for clients from elsewhere. In order to improve their whole experience, the broker additionally secured a Comoros license and intends to transfer international clients under Comoros control.

Octa works with the intermediary Orinoco Capital in South Africa, registered under Financial Sector Conduct Authority (FSCA) under license number 51913 and with a Category I FSP license. For South African customers, Orinoco Capital acts as a point of contact managing complaints and guaranteeing local regulatory compliance to safeguard client funds as mandated by South African laws.

List of Important Financial Assets Available at Octa

Octa Account Types

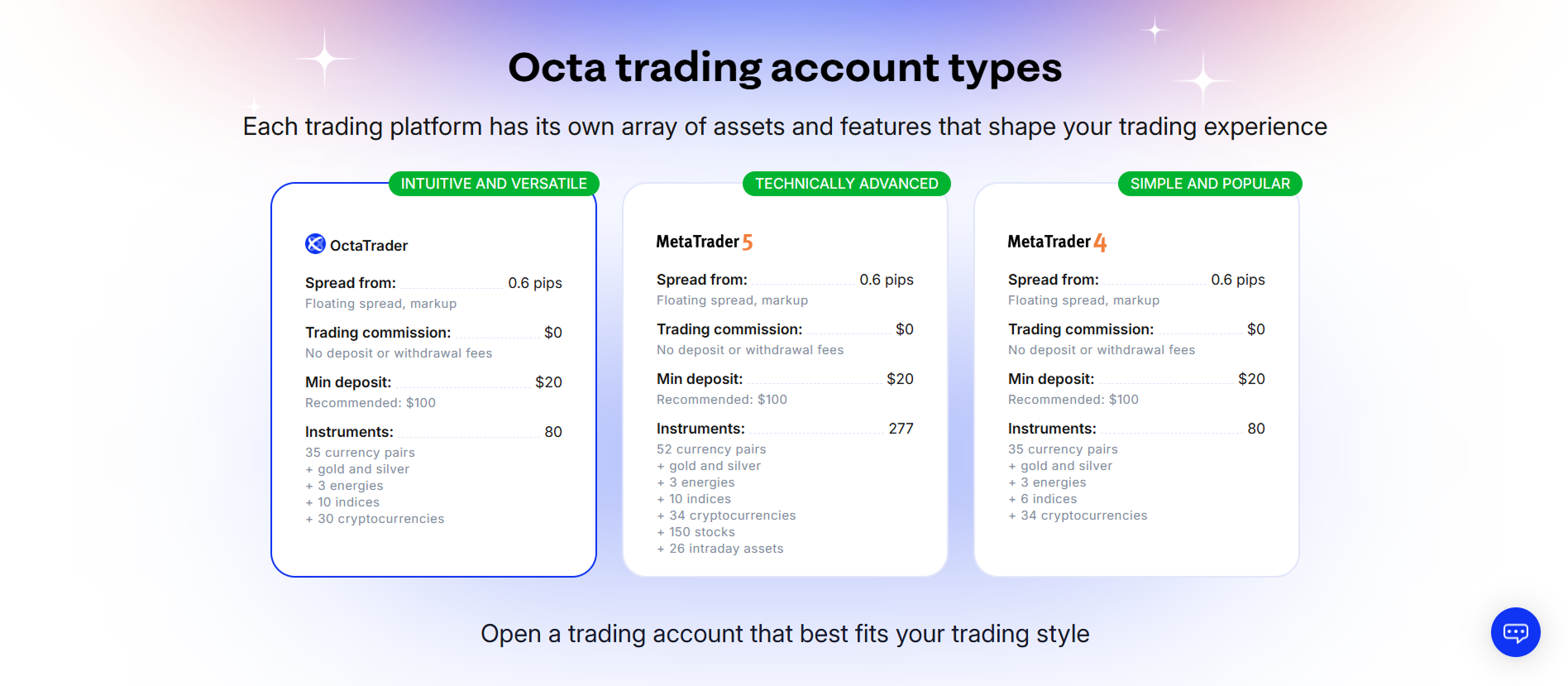

In forex trading, having the correct account is really vital. Octa offers three various account models to fit various trading needs and preferences. Let’s thoroughly discuss every kind of account.

| OctaTrader Account | MetaTrader 5 Account | MetaTrader 4 Account |

| Offering a spread from just 0.6 pip, OctaTrader is the preferred tool for many traders. This account guarantees competitive rates by having a variable spread with markup. The best component is Not one trade commission, deposit fee, or withdrawal fee. Accessible for traders of all types, it has a minimum deposit of just $25 (recommended: $100). Explore a wide spectrum of instruments including thirty cryptocurrencies, gold and silver, three energies, ten indexes, and thirty-five currency pairs. With a 50% deposit bonus, enjoy best utilization of 1:1000 in Forex and appealing bonuses. The OctaTrader account is meant for anyone looking for a flawless trading environment with ample freedom. | The MetaTrader 5 account with Octa is the solution for traders yearning for a wider range of instruments. Starting at 0.6 pips, this account reflects OctaTrader’s fee structure—no trading commission, deposit fees, or withdrawal fees. A minimum deposit of $25—recommended to be $100—opens a universe of 277 instruments. Invest 52 pairs of currencies, gold and silver, 3 energies, 10 indexes, 34 cryptocurrencies, 150 stocks, and 26 intraday assets. With leverage up to 1:1000 in Forex, the MetaTrader 5 account spans 1:40 for stocks. Presenting a substantial 50% deposit bonus, it becomes a flexible choice for traders trying to vary their portfolios. | Octa trade covers people who would rather have the traditional MetaTrader 4 experience. Adhering to the same fee structure as the other accounts, the MetaTrader 4 account shows a spread from 0.6 pip; there is no trading commission, deposit fee, or withdrawal fee. This account fits both new and experienced traders with a minimum deposit of $25 (suggested: $100). Get access to 80 instruments in total—35 pairs of currencies, gold and silver, 3 energies, 6 indexes, and 34 cryptocurrencies. The MetaTrader 4 account pays a 50% deposit bonus and keeps a maximum leverage of 1:1000 in Forex. With a maximum order size of 200 lots, it is a constant option for traders since it finds a mix of power and simplicity. Apart from these Octa stories, they also provides Islamic account for Muslim traders. You might also register a demo account with them before deciding anything. |

Octa Demo Account

Your key to opening the trading world free from danger is the Octa demo account. Before starting actual investments, this Forex practice ground lets you learn the hints of the trading platform and understand the dynamics of the Forex market.

Access the risk-free demo trading account without making any deposits to develop your abilities free from actual money loss. With simulated funds, the Octa demo account reflects all the features of its actual version, so providing you a real trading experience.

Why opt for the Octa demo account?

Octa Payments and Fees

Octa tries to create a trader-friendly environment and gives openness first priority. Their products have simplified and they now provide MT4 and MT5, formerly known as MT4 Micro and MT5 Pro. Especially, they have removed cTrader Octa from their choices.

Guaranteeing fairness, spreads on MT4 and Octa MT5 are now equal. On both platforms, the normal spread on the highly traded EUR/USD currency pair is a minimum 0.6 pip. While Octa MT4 provides 71 instruments to suit different trading tastes, Octa MT5 delivers an impressive 252 instrument count.

Their traders find great advantage in all accounts being swap-free. They thus do not impose any overnight costs, so improving the efficiency of your trading. At Octa, they want to create a setting free of hidden fees so traders may focus on their plans and objectives.

Octa Leverage

Octa broker thinks in enabling its traders with various leverage choices over a wide spectrum of instruments. Their platform gives leverage up to an amazing 1:1000 and offers trading with 52 currency pairings.

Octa traders can explore 150 selections from 16 stock exchanges for CFDs on stocks, all with leverage of 1:40 and zero commission, thereby ensuring cost-effectiveness for our customers. Researching indices? Octa offers leverage up to 1:400 and covers you with ten trading indexes.

It provides trading for the commodities on five main assets: Gold, Silver, Natural Gas, Brent Crude, and WTI Crude. Here traders can use leverage up to 1:200, so giving their efforts in the commodity market more freedom.

The broker supports over 34 cryptocurrency pairs for fans of cryptocurrencies, including well-known choices including Bitcoin, Ethereum, Litecoin, Ripple, and more. Using 1:200, traders can participate in crypto trading around-the-clock and grab chances in this quickly changing industry.

Usually, Octa understands the value of customized leverage choices since they let traders to maximize their tactics throughout several asset types. Discover the might of leverage at Octa and elevate your trading.

Octa Trading Platforms

Navigating the financial markets calls for a consistent and easy-to-use trading platform, and Octa recognizes the requirement of offering choices to fit every trader’s demands. Although EU zone traders only use the MT5 platform, users in other countries benefit from the adaptability of both MT4 and MT5, therefore providing a wider range of options.

OctaTrader aims to minimize risks, offer a better market picture, and streamline decision-making. As they get ready for a worldwide demos release and a full-scale debut for actual trading in not too distant future, keep tuned for updates. Here is the development of trading platforms; Octa broker is setting the path.

Octa APP

Octa makes everything easier for trading! Two Octa trading apps let Android users follow tactics of experts: one for self-trading and another for Copy trading. Users of iOS devices love the General Octa trading app available anywhere. Users of Android can request Octa app APKs. While others have options between MT4 and MT5, EU traders need MT5. Trade boldly everywhere, at any time!

Octa Copying trading

Your route to success is octa’s copy trading tool. Given more than 3340 systems at hand, it has never been more simple to identify profitable approaches. Although 630 suppliers have shown profitability over the past three months, it is important to keep in mind that this information is changing since Octa is upgrading its ranking system. The predicted improvement in the Masters’ ranking will help to more fairly depict their performance.

Adding a layer of intelligence, based on our Octa copy trading analysis, the broker presents the Risk Score function—an automated indicator of the risk connected with every Master Trader’s approach. Computed using a specific algorithm, the Risk Score considers the average profit of a Master Trader, order volume, and strategy stability. This brings a basic change whereby copiers may choose a Master Trader depending on the reliability of the approach as well as their profit.

Masters with a score of 1 or 2 on a 6-point scale offer copiers a complete picture of informed decision-making since they employ more consistent, long-term-oriented, and less dangerous tactics. Octa Copy Trading is the fusion of simplicity and savvy investing.

Octa Review: Research

Research at Octa Trade goes beyond raw data and focuses on smart, well-structured strategies. The broker works closely with independent data laboratories as well as its own in-house analysts, drawing on insights from experienced forex professionals.

This collaborative approach transforms complex market information into clear, practical insights that truly matter—helping traders make informed, confident, and well-timed financial decisions.

Octa Review: Education

Octa offers a rich library of educational resources designed for both beginners and experienced traders. You can start by exploring all platform features through a demo account, allowing you to practice and build confidence without any risk.

Beyond that, Octa’s education team plays an active role in guiding traders at every stage—much like a dedicated group of trading mentors. Their official YouTube channel features comprehensive Forex Basics courses available in multiple languages, including English, Malay, Indonesian, Hindi, and Urdu, making learning accessible and engaging for a global audience.

For those who enjoy learning with a touch of entertainment, Octa also runs the “Trading with the Stars” program. This unique initiative blends education with interactive sessions and is available in Urdu, Malay, and Hindi.

Every Saturday, Octa hosts beginner-focused workshops led by experienced educators. Manish Patel conducts the Indian Saturday Workshop in Hindi, Gero Azul leads the Malay Workshop, while Vito and Eco Bagus host in-depth three-day seminars in English and Indonesian.

Traders who prefer real-time learning can join webinars, live trading sessions, and Q&A discussions in English, Malay, Indonesian, Urdu, and Hindi. These live events bring professional guidance straight to your home, helping you sharpen your skills in real market conditions.

Overall, Octa’s education program acts as a clear roadmap toward becoming a confident and skilled trader—focusing not just on numbers, but on long-term trading growth and discipline.

Withdrawal and Deposit

Depositing funds into your Octa account or withdrawing your earnings is simple and hassle-free. For traders based in the EU, Octa supports a wide range of payment options, including bank transfers, digital wallets, and major credit and debit cards—all with no additional fees charged by the broker.

EU clients can choose from payment methods such as Visa/Mastercard, Swissquote Bank SA, Rietumu Bank, BlueOrange Bank, and Skrill. The minimum deposit and withdrawal requirements are kept trader-friendly, starting from €50 for credit cards, Skrill, and bank transfers. Certain deposit options even allow smaller amounts, ranging from €0.01 to €50, depending on the method.

Overall, Octa’s flexible payment system makes managing your trading funds smooth, secure, and convenient—giving you full control over your money when you need it.