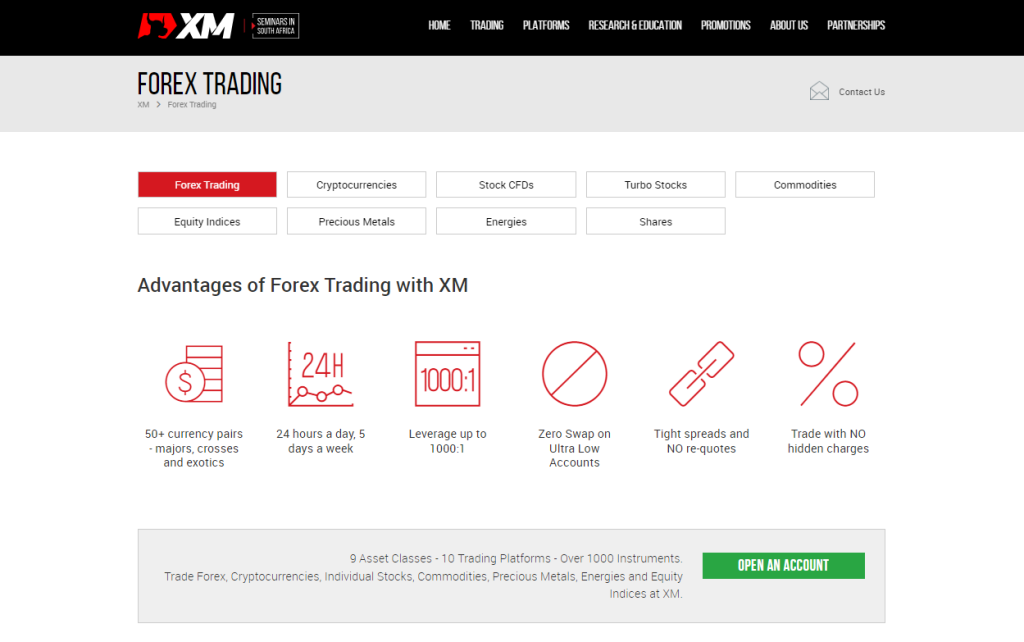

Offers a wide range of trading instruments and competitive trading conditions.

XM a prominent global broker, was founded in 2009. It has since grown significantly, serving over 10 million clients worldwide. Regulated by reputable authorities like the Cyprus Securities and Exchange Commission (CySEC), the International Financial Services Commission (IFSC), and the Australian Securities and Investments Commission (ASIC), XM prioritizes client security and transparency. Operating in multiple countries and offering multilingual support, XM caters to a diverse clientele. Their product range includes Forex, CFDs on stocks, indices, commodities, and cryptocurrencies, providing traders with ample opportunities across various asset classes.

- Regulated

- Diverse Account Types

- User-Friendly Platforms

- Educational Resources

- BestCustomer Support

- Fast Execution Speeds

- Higher Spreads on Standard Accounts

- Limited Platform Option

- Inactivity Fees

XM offers a comprehensive education center designed to empower traders of all levels. Their educational resources include a vast library of video tutorials covering fundamental and advanced trading concepts, from forex basics to technical analysis and risk management strategies. Additionally, XM provides daily market analysis and webinars conducted by experienced analysts, offering insights into current market trends and potential trading opportunities.

Traders can also benefit from their economic calendar and educational articles, keeping them informed about upcoming economic events and their potential impact on the market. By leveraging XM’s robust education platform, traders can enhance their knowledge, refine their skills, and make informed trading decisions.

Is XM a Trustworthy Broker?

- Regulation: Regulated by FSA Seychelles

- Security: Offers segregated client funds and advanced security measures.

- Reputation: Well-established broker with a positive reputation in the industry.

- Customer Support: Provides 24/5 multilingual customer support.

QUICK VIEW

| Minimum Deposit | 5 $ |

| Leverage | 888 : 1 |

| Scalping | No |

| Volume | 50 lots |

| Minimum Lot | 0.01 lots |

| Margin Call | 50% |

| Stop Out | 20% |

| Spread | Floating |

| Execution | Market |

| Islamic Account | Not Available |

FEES

| Commission | N.A |

| Inactivity fee | After 3 months |

FUND MANAGERS & INVESTORS

| Social Trading | Available |

| Pamm Trading | Not Available |

INSTRUMENTS AVAILABLE FOR TRADE

CFDs, Energies, Indices, Metals, Stocks

OVERALL

XM is a well-regulated broker known for its user-friendly platform and diverse trading instruments. It offers competitive spreads, especially on its Zero account, and a variety of account types to suit different trading styles. However, some users have reported occasional slippage and slower execution speeds during high-volatility periods. Additionally, while XM provides educational resources, some traders may find them insufficient for advanced learning.

Before you proceed with opening an account or placing any order, please ensure that you have thoroughly read and understood all the legal documents provided by XM.

Disclaimer: Information Accuracy

We strive to provide accurate and up-to-date information. However, if you notice any discrepancies or errors in the content provided, please don’t hesitate to contact us at [email protected]. Your feedback is valuable in helping us maintain the quality of our information.