AvaTrade offers a comprehensive range of educational resources for traders of all levels. Their learning center provides a wealth of materials, including video tutorials, webinars, and eBooks. These resources cover fundamental concepts like market analysis, risk management, and trading psychology, as well as advanced topics like technical and fundamental analysis.

While some users praise the quality and variety of educational content, others have expressed that the platform could benefit from more interactive learning experiences and personalized guidance. While AvaTrade’s educational offerings are generally well-regarded, it’s essential to consider your individual learning style and preferences when evaluating their suitability for your needs.

Is Ava Trade a Trustworthy Broker?

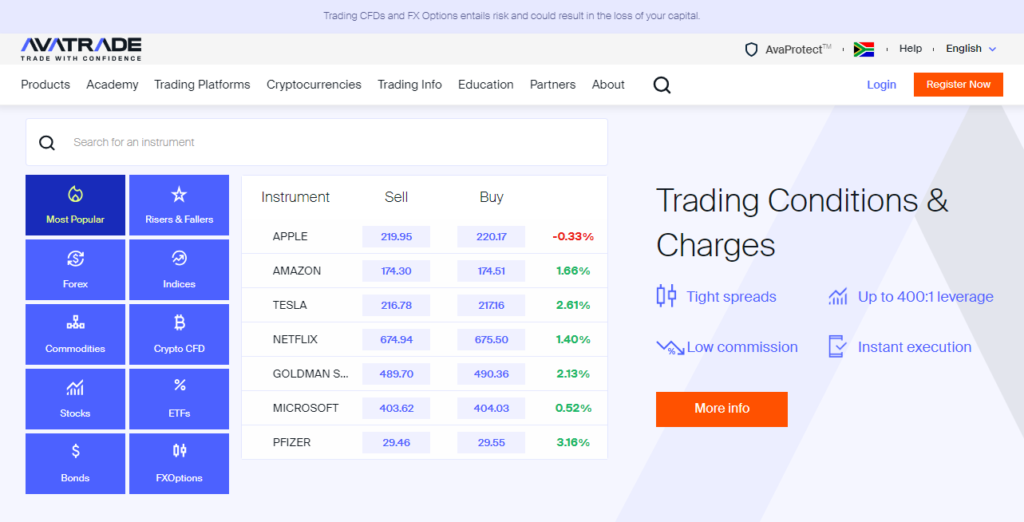

Diverse Offerings: Offers a wide range of trading instruments, including forex, stocks, commodities, and cryptocurrencies.

User-Friendly Platform: Provides a user-friendly platform with a variety of trading tools and features.

Educational Resources: Offers a comprehensive education center with tutorials, webinars, and market analysis.

Customer Support: Provides responsive customer support through multiple channels.

Higher Spreads Compared to Some Competitors: While spreads are competitive, they might be higher than those offered by some other brokers.

Mixed Reviews on Customer Support: While many users praise the support team, some have reported occasional delays or less-than-ideal experiences.

Complex Fee Structure: The fee structure can be complex, especially for beginners.

| Founded | 2006 |

| Headquarters | Dublin, Ireland |

| Regulation | ASIC, FSA, FFAJ, ADGM, CBI, FSCA |

| Tradable Assets | Forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, FX options |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Min Deposit | $100 |

| Leverage | Up to 1:30 (retail)/1:400 (professional) |

| EUR/USD Spread | 0.9 pips |

| Trading Platform | AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, DupliTrade |

| Payment Method | MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto |

| Inactivity Fee | $/€/£50 after 3 consecutive months of non-use |

| Customer Support | Live chat, contact form, WhatsApp: +447520644093, phone (vary by the region) |

Is Avatrade Legit?

Avatrade is regulated by multiple financial regulatory authorities, including the Australian Securities and Investments Commission (ASIC), the Financial Services Authority (FSA), the Financial Futures Association of Japan (FFAJ), the Abu Dhabi Global Market of the United Arab Emirates (ADGM), the Central Bank of Ireland (CBI), and the Financial Sector Conduct Authority of South Africa (FSCA). These regulatory bodies ensure that Avatrade operates with transparency, integrity, and in compliance with regulatory requirements.

Account Type

When it comes to account types, Avatrade only offers a standard account. This means that all clients will have access to the same features and trading conditions, regardless of the size of their deposit.

Avatrade has a minimum deposit requirement of $100, which is relatively low compared to other brokers in the industry. However, there are other brokers that have a lower minimum deposit requirement than Avatrade. For instance, HFM and XM have a minimum deposit requirement of $0 and $5, respectively.

Demo Account

Avatrade offers demo accounts for traders who want to practice their trading skills or test out the trading platform without risking real money. The demo account allows traders to access the full range of trading instruments and features on the Avatrade platform using virtual funds. It is a useful tool for new traders to get familiar with the platform and for experienced traders to test new strategies before using them in live trading. The demo account is available for 21 days and can be renewed upon request.

Leverage

Avatrade offers leverage of up to 1:400 for forex trading and up to 1:200 for other instruments such as commodities and indices. This means that traders can control a larger position with a smaller amount of capital. However, it’s important to keep in mind that leverage can magnify both profits and losses, and traders should use it responsibly and with caution.

Avatrade also offers a range of leverage options for different account types, including 1:30 for retail clients in compliance with ESMA regulations and 1:400 for professional clients. It’s important to note that professional clients must meet certain criteria to qualify for higher leverage.

Spreads & Commissions (Trading Fees)

Avatrade offers competitive spreads and charges no commission fees for trading on its platform. The spreads offered by Avatrade vary depending on the trading instrument and market conditions. For example, the typical spread for EUR/USD is 0.9 pips, while for GBP/USD, it is 1.5 pips. Spreads for other instruments, such as indices and commodities, also vary.

However, it’s important to note that spreads can vary depending on market conditions and volatility. Additionally, Avatrade charges commissions on certain trading instruments such as CFDs, which can impact the overall cost of trading.